By Zhuge Liang

What’s the next mover?

Finance Sector The Next Mover

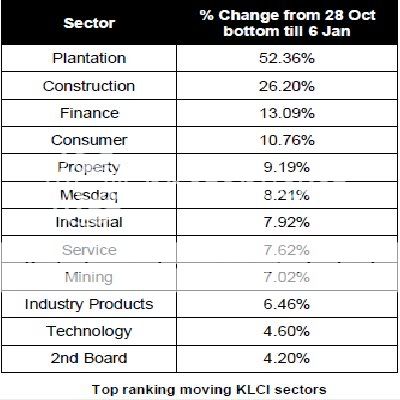

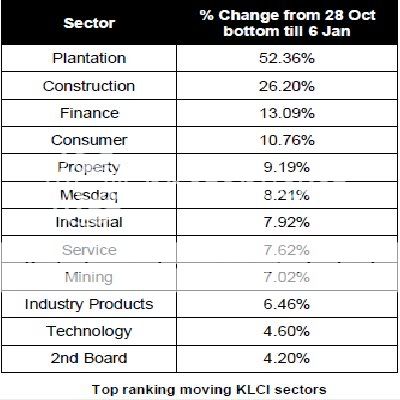

After the huge surge in the KLCI in the last few trading days alone and with some of our recent stock picks making as much as 20% gains, it’s getting increasingly tricky to pick stocks. The million dollar question is, which stocks will move next which are at the same time considered safe for a trade? To answer that question, let’s take a look at the various KLCI sectors.

Top Mover : Plantation Sector (52%)

Based on the charts above, the sector that has moved most from the 28 Oct low till yesterday is the Plantation Sector, with a whopping 52.3% gains. The strength in plantation stocks is due to the war ongoings in Gaza which has resulted in a rebound of oil prices and a similar correlated rebound of Crude Palm Oil (CPO) Prices.

Second Top Mover : Construction Sector (26%)

The second top moving sector is the Construction Sector with an mpressive 26.2% gains since October’s low. The strength of the Construction Sector can be attributed to the UMNO Election theme which is due in March.

Which sector to ride on : Finance Stocks

The trick to choosing the next batch of stocks to ride the KLCI bull is to choose the sector with

a good story to tell and of which has not moved up much yet. Of the remainder sectors, the Finance Sector is our top pick as it has only moved up 13% since the October low. What’s more, in any rally of this magnitude, finance stocks like MAYBANK, AMMB and COMMERZ can always be counted on to participate in this rally.

Finance Stock – Clue to end of short term rally

Besides finance stocks, we see no other good stories in the local mart. Hence, our cue to exit this current short term rally would be when the Finance Sector makes another additional 15%-20% of gains. When that happens, we would be taking profits and exiting our long positions in KLCI stocks..

Please subscribe to Bursa Chat. We will send you the latest post by Email

===> Click Subscribe to Bursa Chat by Email

Subscribe to Bursa Chat by Email

BACK TO CHAT BOX

After the huge surge in the KLCI in the last few trading days alone and with some of our recent stock picks making as much as 20% gains, it’s getting increasingly tricky to pick stocks. The million dollar question is, which stocks will move next which are at the same time considered safe for a trade? To answer that question, let’s take a look at the various KLCI sectors.

Top Mover : Plantation Sector (52%)

Based on the charts above, the sector that has moved most from the 28 Oct low till yesterday is the Plantation Sector, with a whopping 52.3% gains. The strength in plantation stocks is due to the war ongoings in Gaza which has resulted in a rebound of oil prices and a similar correlated rebound of Crude Palm Oil (CPO) Prices.

Second Top Mover : Construction Sector (26%)

The second top moving sector is the Construction Sector with an mpressive 26.2% gains since October’s low. The strength of the Construction Sector can be attributed to the UMNO Election theme which is due in March.

Which sector to ride on : Finance Stocks

The trick to choosing the next batch of stocks to ride the KLCI bull is to choose the sector with

a good story to tell and of which has not moved up much yet. Of the remainder sectors, the Finance Sector is our top pick as it has only moved up 13% since the October low. What’s more, in any rally of this magnitude, finance stocks like MAYBANK, AMMB and COMMERZ can always be counted on to participate in this rally.

Finance Stock – Clue to end of short term rally

Besides finance stocks, we see no other good stories in the local mart. Hence, our cue to exit this current short term rally would be when the Finance Sector makes another additional 15%-20% of gains. When that happens, we would be taking profits and exiting our long positions in KLCI stocks..

===> Click

BACK TO CHAT BOX

.png)

No comments:

Post a Comment