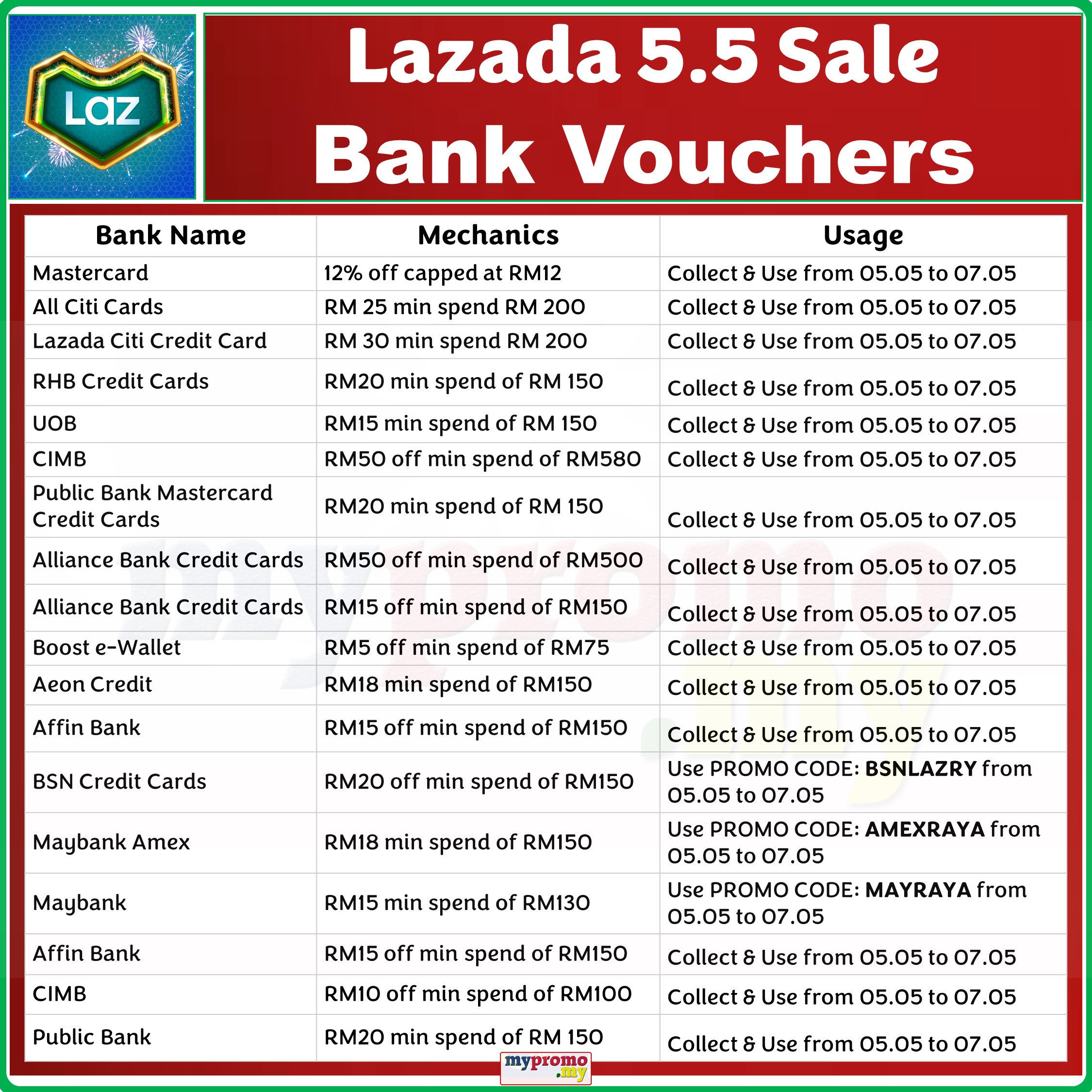

Lazada Bank/Partner Vouchers & Offers

Link: https://mypromo.my/lazada/bank/vouchers

Links to specific bank to collect their vouchers.

CIMB > https://mypromo.my/laz-cimb

Citi > https://mypromo.my/laz-citi

Lazada Citi Card > https://mypromo.my/lazadaciti

Alliance Bank > https://mypromo.my/laz-alliance

Public Bank > https://mypromo.my/laz-pbb

Affin Bank > https://mypromo.my/laz-affinbank

Aeon Credit > https://mypromo.my/laz-aeoncr

RHB > https://mypromo.my/laz-rhb

Boost > https://mypromo.my/lazada/boost

BSN > https://mypromo.my/laz-bsn

Maybank > https://mypromo.my/laz-mbb

Get RM10 Free With BigPay MasterCard. My referral code: AQP50NWLUE

Easy steps to signup : http://bit.ly/BigPayBC

Disclaimer: None of the content published on Bursa Chat constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.