Friday, December 31, 2010

Tuesday, December 28, 2010

BY ROBERT DEEL

Taking control in the management of your money in today’s world is perhaps one of the most important financial imperatives facing us all. This checklist should serve you well, and possibly keep you from becoming a victim of the market and false media information.

In my twenty-one years of trading experience I have found these rules to be an invaluable way of keeping me focused on the trade. Deel’s 15 Rules of Investology

1. TRADE WITH A PLAN

Set objectives before you ever buy. Define all outcomes—not only what

you will do when it goes right, but what you will do if you are wrong.

Determine the amount of capital you are willing to lose and conversely,

define when you will take profits. Letting the market take away your

profits by holding on to a losing trade is not a good strategy. Write out

a trading plan on paper and follow it. Do not become a causality of

emotionally involved buy or selling. Trade with a plan.

2. SCREEN YOUR TRADES

To select trading vehicles you must have a predefined method. Select a

method based on price momentum and trend. Don’t guess what the

future is going to be, trade the current trend direction. Your method must

consider your individual time frame and risk tolerance. Always address

liquidity, sector rotation, and technical factors when screening stocks.

3. ALWAYS LOOK AT A CHART

Never buy a stock without looking at a chart of the stock first. Look at

the one-year trading range. Ascertain where you currently are in the

trend and what that trend is. Also determine if the chart reflects a stock

split. Never trade against the trend. Buying and selling decisions are

technical in nature. Fundamentals will never tell when to buy or sell a

stock. Always look at a chart for entry and exit timing decisions.

4. STAY WITH A TREND

Your probabilities of success are far greater if you stay with a definable

market trend. Statistically, these trends provide better profit potential

with a lower amount of risk. A good rule of thumb is to watch a 50-day

exponential moving average of the close. This moving average represents

the intermediate trend of a stock. A 12-day exponential moving average

represents short-term trend. The use of these two moving averages

should yield excellent results in keeping you in the trend. If you perceive

the trend beginning to change, act accordingly by taking profits or plac-

ing stops to protect your capital and locking in a profit.

5. USE MONEY MANAGEMENT TECHNIQUES

Determine the probable dollar losses of your trading plan or investment

style based on your trading record for the current year. Then devise a

way to generate income through passive sources.

Cutting a loss quickly is the best money management you can have.

Too many times traders fall in love with stock, holding on as the stock

begins to decline. Never use a hedging strategy, such as options, to

justify holding on to a losing position.

The use of money market, bond, and stock dividend income to off-

set losses in your trading portfolio is an excellent technique.

Covered call options may be an appropriate way to generate income

for your portfolio to offset losses. Be careful here because you can write

covered calls into oblivion. If the stock is going against you, sell it.

If you are going to hold a trade overnight, never risk more than 3%

of your available capital. If you are going to day trade, an excellent rule

of thumb is to only risk 1% of your capital in any one trade.

6. BUY AND SELL ON CONFIDENCE

Many times you won’t feel quite right about a buy or sell decision.

If this feeling persists after you have done all your research and you have

followed the rules to this point, don’t take the trade. Too many times

individuals try to rationalize a decision. Don’t try to find a good reason

for making a bad decision. Your decision must be a confident one.

7. BUY ONLY LIQUID STOCKS AND LIQUID MARKETS

Stay with major markets and stocks with millions of shares in the float.

Make sure the average trading volume is enough for you to sell all of

your position on any given day. By following this rule you should be

assured of a reasonably good execution of your trade. Don’t buy stocks

trading at the lower end of the price range. Generally speaking, do not

buy stocks that don’t have good trend characteristics or predictability.

True professional traders avoid them and so should you.

8. DON’T BUY OR SELL ON HOT TIPS

More money has been lost on hot tips than is in the U.S. Treasury. While

this is an exaggeration, it does make the point clear. If someone tells you

about an investment or trade, research the recommendation before you

put your money into it. Most novice investors and traders fall victim to

tips every day. Please don’t fall for the story no matter how good it

sounds. Always use technical analysis to make your buy and sell deci-

sions, and buy or sell based on facts.

9. DO NOT DOLLAR COST AVERAGE

If your timing decision was wrong on an aggressive stock, don’t make

the problem worse by trying to buy a stock that is going lower. The prob-

ability is that you will only compound the loss. I call this technique

disaster cost averaging. Don’t buy a stock until the trend is evident.

Dollar cost averaging is good for your broker, but if you continue this

technique, the ‘broker’ you will become.

10. NO ONE WINS 100 % OF THE TIME

Many people enter the stock market focused only on the profits and do

not consider the losses. If you think for one minute you are going to

win one hundred percent of the time, you are wrong. Losing is just part

of the cost of doing business. Your goal is to make sure you control the

risk and not blindly put your money at risk, like a buy and hold

investor. You must come to the realization that you will never learn how

to win until you first learn how to lose. How you handle loss psycholog-

ically is truly the difference between an amateur and a professional.

Professional traders don’t react the same way as an amateur to loss.

When a professional trader loses, he or she simply says next.They don’t

take the loss personally.

11. ALWAYS USE STOPS

The proper use of stops will protect profits and limit your losses. Look at

stops as profit and loss insurance. When you enter a trade, you place a

stop to limit the loss in case the trade goes against you. When the trade

becomes profitable, you use them to lock in a profit.

Anyone who would argue against risk control by discouraging the

use of stops is a fool indeed. In effect they are saying you should put

your capital at unlimited risk. Does this make any sense to you? Of

course not, but that is exactly what a buy and hold investor does all the

time. Most investors do not use stops because they are afraid of being

stopped out. This is a psychological problem of not wanting to be

wrong, or having to admit to yourself you lost on a trade. It certainly

isn’t based on logic or strategy. Remember, always use stops if you are

carrying a trade over night.

12. I DON’T HAVE TIME

Make the time or suffer the consequences. If you are too busy to man-

age your money, maybe you’re too busy. Take a look at your portfolio

and if you lost half of your money without knowing it, you can congratu-

late yourself on being too busy. Was it worth it? Probably not. It doesn’t

make much sense to work yourself to death and have nothing to show

for it. You must take time to educate yourself and take control of your

future.

13. BE PATIENT AND LET TIME BE YOUR FRIEND

Making money safely takes time. The only time to hurry is when you’re in

trouble. Remember, “Everyday is not a trading day”. Only trade when

the sector, market, and the correlating stocks are in trend. Just because

you want to trade doesn’t mean you should. Only trade when the proba-

bilities are in your favor, and let the market come to you.

The market is going to do what it is going to do and what you want is

irrelevant. Don’t become addicted to the action. You are not an action

junky. You are a high probability trader. Profits are made the old fash-

ioned way, one trade at a time. Be patient and make time your friend

instead of your enemy.

14. LEARN FROM YOUR MISTAKES

The most successful traders and aggressive investors learn from their

mistakes. Many even go as far as writing down what went wrong and

analyzing the problem. Mistakes can be costly, so use them as learning

experiences and don’t make the same mistake twice.

Unfortunately a large number of people are doomed to make the

same mistakes over and over again. This behavior is usually a sign of

emotional reactions to price momentum and the absence of any well

thought out strategy. My father once told me that the best education

was to learn from the mistakes of others. Most people fail in the market

not because of technology or a lack of information, but because of

emotional reactions, and never learning from their mistakes and the

mistakes of others.

15. FOLLOW THE RULES

Some people are doomed to make the same mistakes over and over

again. Using this set of 16 trading rules, which has been compiled

from over 20 years of experience, should keep you from making many

common mistakes.

If you follow Deel’s Rules of Investology, you have a much better

chance of success than someone who doesn’t. Always remember, there

is never any guarantee of success. But if you are properly educated and

develop the correct mindset, you have a major advantage. Don’t

become one of the sheep led to the slaughter by media nonsense.

You must make your own fortune and control your financial destiny.

Always remember, it’s your money. Take control…and follow the rules.

Robert Deel is an internationally recognized trading expert, and has trained groups of traders

throughout the U.S., Europe, Asia, and Canada. He is the author of Trading the Plan and The

Strategic Electronic Day Trader. He is also the President and CEO of Tradingschool.com, a

school that trains individual and professional traders from all over the world.

Taking control in the management of your money in today’s world is perhaps one of the most important financial imperatives facing us all. This checklist should serve you well, and possibly keep you from becoming a victim of the market and false media information.

In my twenty-one years of trading experience I have found these rules to be an invaluable way of keeping me focused on the trade. Deel’s 15 Rules of Investology

1. TRADE WITH A PLAN

Set objectives before you ever buy. Define all outcomes—not only what

you will do when it goes right, but what you will do if you are wrong.

Determine the amount of capital you are willing to lose and conversely,

define when you will take profits. Letting the market take away your

profits by holding on to a losing trade is not a good strategy. Write out

a trading plan on paper and follow it. Do not become a causality of

emotionally involved buy or selling. Trade with a plan.

2. SCREEN YOUR TRADES

To select trading vehicles you must have a predefined method. Select a

method based on price momentum and trend. Don’t guess what the

future is going to be, trade the current trend direction. Your method must

consider your individual time frame and risk tolerance. Always address

liquidity, sector rotation, and technical factors when screening stocks.

3. ALWAYS LOOK AT A CHART

Never buy a stock without looking at a chart of the stock first. Look at

the one-year trading range. Ascertain where you currently are in the

trend and what that trend is. Also determine if the chart reflects a stock

split. Never trade against the trend. Buying and selling decisions are

technical in nature. Fundamentals will never tell when to buy or sell a

stock. Always look at a chart for entry and exit timing decisions.

4. STAY WITH A TREND

Your probabilities of success are far greater if you stay with a definable

market trend. Statistically, these trends provide better profit potential

with a lower amount of risk. A good rule of thumb is to watch a 50-day

exponential moving average of the close. This moving average represents

the intermediate trend of a stock. A 12-day exponential moving average

represents short-term trend. The use of these two moving averages

should yield excellent results in keeping you in the trend. If you perceive

the trend beginning to change, act accordingly by taking profits or plac-

ing stops to protect your capital and locking in a profit.

5. USE MONEY MANAGEMENT TECHNIQUES

Determine the probable dollar losses of your trading plan or investment

style based on your trading record for the current year. Then devise a

way to generate income through passive sources.

Cutting a loss quickly is the best money management you can have.

Too many times traders fall in love with stock, holding on as the stock

begins to decline. Never use a hedging strategy, such as options, to

justify holding on to a losing position.

The use of money market, bond, and stock dividend income to off-

set losses in your trading portfolio is an excellent technique.

Covered call options may be an appropriate way to generate income

for your portfolio to offset losses. Be careful here because you can write

covered calls into oblivion. If the stock is going against you, sell it.

If you are going to hold a trade overnight, never risk more than 3%

of your available capital. If you are going to day trade, an excellent rule

of thumb is to only risk 1% of your capital in any one trade.

6. BUY AND SELL ON CONFIDENCE

Many times you won’t feel quite right about a buy or sell decision.

If this feeling persists after you have done all your research and you have

followed the rules to this point, don’t take the trade. Too many times

individuals try to rationalize a decision. Don’t try to find a good reason

for making a bad decision. Your decision must be a confident one.

7. BUY ONLY LIQUID STOCKS AND LIQUID MARKETS

Stay with major markets and stocks with millions of shares in the float.

Make sure the average trading volume is enough for you to sell all of

your position on any given day. By following this rule you should be

assured of a reasonably good execution of your trade. Don’t buy stocks

trading at the lower end of the price range. Generally speaking, do not

buy stocks that don’t have good trend characteristics or predictability.

True professional traders avoid them and so should you.

8. DON’T BUY OR SELL ON HOT TIPS

More money has been lost on hot tips than is in the U.S. Treasury. While

this is an exaggeration, it does make the point clear. If someone tells you

about an investment or trade, research the recommendation before you

put your money into it. Most novice investors and traders fall victim to

tips every day. Please don’t fall for the story no matter how good it

sounds. Always use technical analysis to make your buy and sell deci-

sions, and buy or sell based on facts.

9. DO NOT DOLLAR COST AVERAGE

If your timing decision was wrong on an aggressive stock, don’t make

the problem worse by trying to buy a stock that is going lower. The prob-

ability is that you will only compound the loss. I call this technique

disaster cost averaging. Don’t buy a stock until the trend is evident.

Dollar cost averaging is good for your broker, but if you continue this

technique, the ‘broker’ you will become.

10. NO ONE WINS 100 % OF THE TIME

Many people enter the stock market focused only on the profits and do

not consider the losses. If you think for one minute you are going to

win one hundred percent of the time, you are wrong. Losing is just part

of the cost of doing business. Your goal is to make sure you control the

risk and not blindly put your money at risk, like a buy and hold

investor. You must come to the realization that you will never learn how

to win until you first learn how to lose. How you handle loss psycholog-

ically is truly the difference between an amateur and a professional.

Professional traders don’t react the same way as an amateur to loss.

When a professional trader loses, he or she simply says next.They don’t

take the loss personally.

11. ALWAYS USE STOPS

The proper use of stops will protect profits and limit your losses. Look at

stops as profit and loss insurance. When you enter a trade, you place a

stop to limit the loss in case the trade goes against you. When the trade

becomes profitable, you use them to lock in a profit.

Anyone who would argue against risk control by discouraging the

use of stops is a fool indeed. In effect they are saying you should put

your capital at unlimited risk. Does this make any sense to you? Of

course not, but that is exactly what a buy and hold investor does all the

time. Most investors do not use stops because they are afraid of being

stopped out. This is a psychological problem of not wanting to be

wrong, or having to admit to yourself you lost on a trade. It certainly

isn’t based on logic or strategy. Remember, always use stops if you are

carrying a trade over night.

12. I DON’T HAVE TIME

Make the time or suffer the consequences. If you are too busy to man-

age your money, maybe you’re too busy. Take a look at your portfolio

and if you lost half of your money without knowing it, you can congratu-

late yourself on being too busy. Was it worth it? Probably not. It doesn’t

make much sense to work yourself to death and have nothing to show

for it. You must take time to educate yourself and take control of your

future.

13. BE PATIENT AND LET TIME BE YOUR FRIEND

Making money safely takes time. The only time to hurry is when you’re in

trouble. Remember, “Everyday is not a trading day”. Only trade when

the sector, market, and the correlating stocks are in trend. Just because

you want to trade doesn’t mean you should. Only trade when the proba-

bilities are in your favor, and let the market come to you.

The market is going to do what it is going to do and what you want is

irrelevant. Don’t become addicted to the action. You are not an action

junky. You are a high probability trader. Profits are made the old fash-

ioned way, one trade at a time. Be patient and make time your friend

instead of your enemy.

14. LEARN FROM YOUR MISTAKES

The most successful traders and aggressive investors learn from their

mistakes. Many even go as far as writing down what went wrong and

analyzing the problem. Mistakes can be costly, so use them as learning

experiences and don’t make the same mistake twice.

Unfortunately a large number of people are doomed to make the

same mistakes over and over again. This behavior is usually a sign of

emotional reactions to price momentum and the absence of any well

thought out strategy. My father once told me that the best education

was to learn from the mistakes of others. Most people fail in the market

not because of technology or a lack of information, but because of

emotional reactions, and never learning from their mistakes and the

mistakes of others.

15. FOLLOW THE RULES

Some people are doomed to make the same mistakes over and over

again. Using this set of 16 trading rules, which has been compiled

from over 20 years of experience, should keep you from making many

common mistakes.

If you follow Deel’s Rules of Investology, you have a much better

chance of success than someone who doesn’t. Always remember, there

is never any guarantee of success. But if you are properly educated and

develop the correct mindset, you have a major advantage. Don’t

become one of the sheep led to the slaughter by media nonsense.

You must make your own fortune and control your financial destiny.

Always remember, it’s your money. Take control…and follow the rules.

Robert Deel is an internationally recognized trading expert, and has trained groups of traders

throughout the U.S., Europe, Asia, and Canada. He is the author of Trading the Plan and The

Strategic Electronic Day Trader. He is also the President and CEO of Tradingschool.com, a

school that trains individual and professional traders from all over the world.

Friday, December 24, 2010

Saturday, December 11, 2010

|

| KLCI Chart |

KUALA LUMPUR, Dec 11 — Shares on Bursa Malaysia are likely to trade firmer next week with more inflow of funds despite the market’s short-term weakness and concerns about China’s monetary policy and the eurozone crisis.

The FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) staying above 1,500 on good volume gave credibility on its resilience, Affin Investment Bank Head of Retail Research Dr Nazri Khan said.

This week, the key market barometer rose by 6.3 points to 1,507.28 after rising near the historic high of 1,528.01 on Thursday on strong buying interest on key heavyweights but succumbing to profit taking a day later as investors opted to sell on strength.

“Despite short term weakness on Friday and concern in China/Europe, we see positive investor risk attitudes in the local equity market, possibly driven by good corporate earnings and ample talks on consolidation exercise,” Nazri said.

Other factors include impending election hype, stronger commodity price, attractive local bond yield and hot-money carry trade play.

The fact that Dow Jones at a new two-year high and Nikkei at a new seven-month high is likely also influence Asian indices, including FBM KLCI, higher.

“We also expect reduced equity volatility for the rest of this month to support FBM KLCI higher given the downtrend of the CBOE Volatility Index which suggests declining investor anxiety,” Nazri said.

The looming “January effect” with year-end accumulation of selected blue chips in the last few weeks of the year is also supportive for the local market.

“Currently, we see the property and construction sectors (with focus on the politically-connected-election-linked counters) as the two sectors dominating the local bourse January effect,” he said.

As the property and construction indices remain very close to three-year highs, there is expectation for more strength of the sectors to push FBM KLCI higher.

“Going forward, we believe the local market is likely to show more resilience with a potential upside break-out next week. Given ample liquidity now, we are not surprised to see FBM KLCI aiming for 1,530 in the near term,” Nazri said.

Any close above 1,530 would lead FBM KLCI to a good bull rally towards an all-time-high of 1,550 in the early part of next year, he added. On a weekly basis, the FBM Emas Index increased by 84.98 points to

10,255.42, the FBM Top 100 Index added 66.2 points to 10,010.48 and the FBM Ace Index jumped 68.28 points to 4,261.36.

The Finance Index increased 217.25 points to 13,767.5 while the Industrial Index was lower by 66.96 points to 2,786.66 and the Plantation Index surged 35.76 points to 7,862.13. Petronas Chemicals was among volume leaders. It ended four sen higher at RM5.58. Its parent company, Petronas, had signed a memorandum of understanding with BASF to undertake a joint feasibility study to produce specialty chemicals in the country which could involve a joint investment of up to RM4 billion.

Tenaga Nasional which had said it would ask the government to review the tariff for natural gas if coal prices were to rise significantly and become a financial burden, dropped 19 sen to RM8.60.

The average coal price has increased to over US$110 a tonne, which will definitely affect the utility giant’s bottom line.

DRB-Hicom which had said that it was not aware of talks on any privatisation proposals, was also actively traded. It added 15 sen to RM1.80.

There was a report saying that Tan Sri Syed Mokhtar Al Bukhary was believed to be considering taking the auto and banking group private.

The market’s weekly volume rose to 4.968 billion shares valued at RM8.94 billion from 4.89 billion shares valued at RM9 billion.

The Main Market turnover declined to 3.754 billion units worth RM8.612 billion from 4.23 billion units worth RM8.85 billion but volume on the ACE Market jumped to 375.025 million shares worth RM84.661 million from 298.08 million shares worth RM84.46 million.

Warrants increased to 827.357 million units valued at RM233.123 million from 347.79 million units valued at RM61.13 million. — Bernama

Wednesday, November 24, 2010

Here I go again….. going to talk about Celcom and BlackBerry… hahaha. You can enjoy the best of both worlds with these latest BlackBerry deals – only with Celcom.

BlackBerry is a gadget you don’t want to leave home without. With Celcom BlackBerry, you can stay connected via email, mobile, internet anytime, anywhere! It allows you to receive emails from your personal and business accounts, receive and open email attachments, browse through your favorite sites, stay in contact with loved ones via Instant messaging, mobile calls, sms & much more!

You can stay updated & connected with all your friends 24/7, wherever you are - with not just e-mails, but Facebook, Twitter and even Foursquare on your Celcom Blackberry! You can upload your pictures, update your status or reply your friends anytime, anywhere! And there’s also the awesome Blackberry Messenger which allows you to chat non-stop from your Blackberry!

THE LATEST BLACKBERRY BOLD 9780 IS NOW HERE WITH MORE POWER-PACKED FEATURES THAN BEFORE!

Just look at the picture ….. beautiful !. Celcom was the 1st in Malaysia to bring us the all-new Blackberry Bold 9780, when it offered the smartphone at Go Mobile! 2010, KL Convention Centre this 13-14 November 2010. Customers, who purchased the phones during the convention, were also entitled to pick up fantastic prizes like a Modenas bike, free phones and much more!

BlackBerry® Bold™ 9780 is power packed with features such as:

- The new BlackBerry® 6 OS, that allows update on your social feeds at once, or surf various websites faster with a richer and more engaging interface.

- Has the longest battery life amongst all phones in the BlackBerry® range with 6 hours of talktime and 38 hours of music playback time.

- Equipped with Wi-Fi® capabilities, you are now able to switch effortlessly between various networks to access your BlackBerry services

- High resolution screen to provide a dazzling display for an engaging experience

- Equipped with a microSD slot, you can now carry all your videos and music wherever you go.

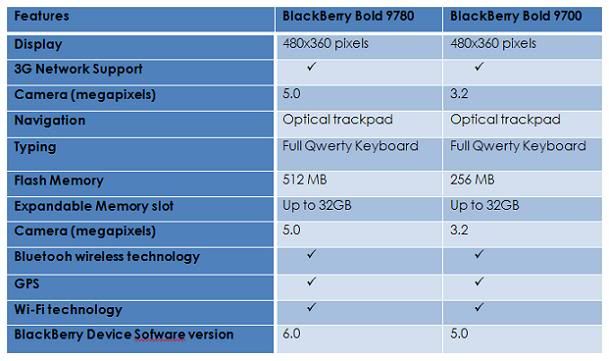

What’s the difference between the Bold 9780 & Bold 9700?

The Bold 9780 comes with the all-new BlackBerry® 6 OS, that allows update on your social feeds at once, or surf various websites faster with a richer and more engaging interface & a cool 5.0 megapixel camera and 512MB flash memory for you to capture, store & share your favourite moments with your loved ones!

OR GET THE BEAUTIFUL CELCOM BLACKBERRY TORCH 9800 AND ENJOY THE BEST OF BOTH WORLDS!

BlackBerry® Torch™ 9800 has a complete host of amazing features which I have mentioned in my post here http://bursa-chat.blogspot.com/2010/11/get-celcom-blackberry-torch-9800-with.html

Can’t wait to be the 1st to own one of these Blackberry® smartphones? Sign up now for the most affordable package price with Celcom. Choose between the following packages available to you:

o Celcom Exec postpaid plans

o Or Celcom Biz

• What’s more, sign up today either with Celcom Exec postpaid plans or Celcom Biz to enjoy FREEBIES such as:

Why choose Celcom? Because Celcom is Malaysia’s No.1 Blackberry provider, with the best deals on Blackberry smartphones and plans! Celcom also offers the wildest mobile network coverage in the country.

Increase the efficiency of your business with Celcom Biz with an extensive range of plans and services enabled through Celcom and BlackBerry from Vodafone such as:

o BlackBerry instant messaging, Yahoo Messenger, Google Talk & Windows LIVE

o Mobile Facebook, Flickr and other subscription services

BlackBerry is a gadget you don’t want to leave home without. With Celcom BlackBerry, you can stay connected via email, mobile, internet anytime, anywhere! It allows you to receive emails from your personal and business accounts, receive and open email attachments, browse through your favorite sites, stay in contact with loved ones via Instant messaging, mobile calls, sms & much more!

You can stay updated & connected with all your friends 24/7, wherever you are - with not just e-mails, but Facebook, Twitter and even Foursquare on your Celcom Blackberry! You can upload your pictures, update your status or reply your friends anytime, anywhere! And there’s also the awesome Blackberry Messenger which allows you to chat non-stop from your Blackberry!

THE LATEST BLACKBERRY BOLD 9780 IS NOW HERE WITH MORE POWER-PACKED FEATURES THAN BEFORE!

Just look at the picture ….. beautiful !. Celcom was the 1st in Malaysia to bring us the all-new Blackberry Bold 9780, when it offered the smartphone at Go Mobile! 2010, KL Convention Centre this 13-14 November 2010. Customers, who purchased the phones during the convention, were also entitled to pick up fantastic prizes like a Modenas bike, free phones and much more!

BlackBerry® Bold™ 9780 is power packed with features such as:

- The new BlackBerry® 6 OS, that allows update on your social feeds at once, or surf various websites faster with a richer and more engaging interface.

- Has the longest battery life amongst all phones in the BlackBerry® range with 6 hours of talktime and 38 hours of music playback time.

- Equipped with Wi-Fi® capabilities, you are now able to switch effortlessly between various networks to access your BlackBerry services

- High resolution screen to provide a dazzling display for an engaging experience

- Equipped with a microSD slot, you can now carry all your videos and music wherever you go.

What’s the difference between the Bold 9780 & Bold 9700?

The Bold 9780 comes with the all-new BlackBerry® 6 OS, that allows update on your social feeds at once, or surf various websites faster with a richer and more engaging interface & a cool 5.0 megapixel camera and 512MB flash memory for you to capture, store & share your favourite moments with your loved ones!

OR GET THE BEAUTIFUL CELCOM BLACKBERRY TORCH 9800 AND ENJOY THE BEST OF BOTH WORLDS!

BlackBerry® Torch™ 9800 has a complete host of amazing features which I have mentioned in my post here http://bursa-chat.blogspot.com/2010/11/get-celcom-blackberry-torch-9800-with.html

Can’t wait to be the 1st to own one of these Blackberry® smartphones? Sign up now for the most affordable package price with Celcom. Choose between the following packages available to you:

o Celcom Exec postpaid plans

o Or Celcom Biz

• What’s more, sign up today either with Celcom Exec postpaid plans or Celcom Biz to enjoy FREEBIES such as:

Why choose Celcom? Because Celcom is Malaysia’s No.1 Blackberry provider, with the best deals on Blackberry smartphones and plans! Celcom also offers the wildest mobile network coverage in the country.

Increase the efficiency of your business with Celcom Biz with an extensive range of plans and services enabled through Celcom and BlackBerry from Vodafone such as:

o BlackBerry instant messaging, Yahoo Messenger, Google Talk & Windows LIVE

o Mobile Facebook, Flickr and other subscription services

Saturday, November 20, 2010

RHB Keeps Fajarbaru At Outperform; MYR1.37 Target

--------------------------------------------------------------------------------

0839 GMT [Dow Jones] STOCK CALL: RHB Research keeps Fajarbaru Builder Group (7047.KU) at Outperform, target at MYR1.37, based on 10X fully-diluted CY11 EPS of 13.7 sen. House says although 1Q net profit came in at only 17% of full-year forecast, expects stronger quarters ahead with new projects attaining their 1st billing milestones. Says firm's 2 key contracts wins recently boosts year-to-date new contracts to MYR99 million, outstanding construction orderbook to MYR496 million. "We are upbeat on construction stocks as we believe they will continue to generally outperform the market from 4Q2010," says RHB. Adds, firm pre-qualified to bid for LRT line extension project as main contractor as well as segmental box girder sub-contractor. Stock down 0.9% at MYR1.11

Affin Keeps WCT At Buy; Target MYR4.04

--------------------------------------------------------------------------------

0731 GMT [Dow Jones] STOCK CALL: Affin Investment maintains Buy rating on WCT (9679.KU), MYR4.04 target. Says, company's 9M net profit within expectations. Lowers FY10 net profit forecast by 2.6% to reflect year-to-date performance of engineering and construction division, but expects "stronger contributions" from both E&C projects, property development. House maintains FY11-FY12 forecast; company's outstanding orderbook at September end was MYR3.2 billion. Adds, company has met guidance of MYR2 billion in new jobs in 2010, property demand should remain strong "with the flush liquidity in the financial system and low interest." Stock last +0.3% at MYR3.03

Hwang-DBS Keeps WCT As Buy; MYR3.60 Target

--------------------------------------------------------------------------------

0837 GMT [Dow Jones] STOCK CALL: Hwang-DBS Vickers Research keeps WCT (9679.KU) as Buy with unchanged MYR3.60 target; construction firm posts 9-month net profit of MYR99.2 million, which equivalent to 65% of house's full-year earnings forecast. "Although the result seems weak, we understand 4Q10 will be a stronger quarter driven by a pick up in both construction and property billings," says Hwang; thus retains net profit forecast of MYR152 million for FY10, MYR178 million for FY11, MYR186 million for FY12. "We continue to like WCT as a cost effective contractor that will benefit from a more open tender system." Adds, given its less diversified earnings base, it is also more leveraged to new contract wins. WCT's current orderbook at MYR3.3 billion. Stock last +0.3% at MYR3.03.

CIMB Trims Xingquan Target To MYR3.04 Vs MYR3.49

--------------------------------------------------------------------------------

0800 GMT [Dow Jones] STOCK CALL: CIMB Research trims Xingquan (5155.KU) target to MYR3.04 from MYR3.49 after scaling back house's FY11-FY13 EPS forecasts for Chinese shoemaker by 8.0%-13% to reflect margin squeeze from sharp rise in raw material prices. This after Xingquan's fiscal 1Q net profit of MYR25.8 million (+20.6% on-year) out of step with house expectations, with annualised core net profit being only 68% of house forecast, mainly due to profit margin erosion. "But Xingquan remains an Outperform as valuations are among the most attractive in the sector. Factors that could give the share price a kick are better-than-expected trade fair orders and a sharp decline in raw material prices," says analyst Nigel Foo. Stock last down 0.6% at MYR1.59

Affin Cuts Kossan Target To MYR4.73; Keeps Buy

--------------------------------------------------------------------------------

0837 GMT [Dow Jones] STOCK CALL: Affin Investment lowers Kossan Rubber Industries (7153.KU) price target to MYR4.73 from MYR5.00 after revising down FY10-12 net earnings forecasts by about 6% due to expected rise in latex prices, stronger MYR vs USD. Maintains Buy rating; says company has "diversified product mix, which buffers its bottomline from higher raw material costs, and high utilization rates." Notes company's 9-month EBIT margin at 15% vs 10.3% a year earlier, driven by robust demand, stronger pricing power, especially in 1H, that allowed company to pass on nearly 100% of escalating latex costs. Stock last +5.6% at MYR3.39.

--------------------------------------------------------------------------------

0839 GMT [Dow Jones] STOCK CALL: RHB Research keeps Fajarbaru Builder Group (7047.KU) at Outperform, target at MYR1.37, based on 10X fully-diluted CY11 EPS of 13.7 sen. House says although 1Q net profit came in at only 17% of full-year forecast, expects stronger quarters ahead with new projects attaining their 1st billing milestones. Says firm's 2 key contracts wins recently boosts year-to-date new contracts to MYR99 million, outstanding construction orderbook to MYR496 million. "We are upbeat on construction stocks as we believe they will continue to generally outperform the market from 4Q2010," says RHB. Adds, firm pre-qualified to bid for LRT line extension project as main contractor as well as segmental box girder sub-contractor. Stock down 0.9% at MYR1.11

Affin Keeps WCT At Buy; Target MYR4.04

--------------------------------------------------------------------------------

0731 GMT [Dow Jones] STOCK CALL: Affin Investment maintains Buy rating on WCT (9679.KU), MYR4.04 target. Says, company's 9M net profit within expectations. Lowers FY10 net profit forecast by 2.6% to reflect year-to-date performance of engineering and construction division, but expects "stronger contributions" from both E&C projects, property development. House maintains FY11-FY12 forecast; company's outstanding orderbook at September end was MYR3.2 billion. Adds, company has met guidance of MYR2 billion in new jobs in 2010, property demand should remain strong "with the flush liquidity in the financial system and low interest." Stock last +0.3% at MYR3.03

Hwang-DBS Keeps WCT As Buy; MYR3.60 Target

--------------------------------------------------------------------------------

0837 GMT [Dow Jones] STOCK CALL: Hwang-DBS Vickers Research keeps WCT (9679.KU) as Buy with unchanged MYR3.60 target; construction firm posts 9-month net profit of MYR99.2 million, which equivalent to 65% of house's full-year earnings forecast. "Although the result seems weak, we understand 4Q10 will be a stronger quarter driven by a pick up in both construction and property billings," says Hwang; thus retains net profit forecast of MYR152 million for FY10, MYR178 million for FY11, MYR186 million for FY12. "We continue to like WCT as a cost effective contractor that will benefit from a more open tender system." Adds, given its less diversified earnings base, it is also more leveraged to new contract wins. WCT's current orderbook at MYR3.3 billion. Stock last +0.3% at MYR3.03.

CIMB Trims Xingquan Target To MYR3.04 Vs MYR3.49

--------------------------------------------------------------------------------

0800 GMT [Dow Jones] STOCK CALL: CIMB Research trims Xingquan (5155.KU) target to MYR3.04 from MYR3.49 after scaling back house's FY11-FY13 EPS forecasts for Chinese shoemaker by 8.0%-13% to reflect margin squeeze from sharp rise in raw material prices. This after Xingquan's fiscal 1Q net profit of MYR25.8 million (+20.6% on-year) out of step with house expectations, with annualised core net profit being only 68% of house forecast, mainly due to profit margin erosion. "But Xingquan remains an Outperform as valuations are among the most attractive in the sector. Factors that could give the share price a kick are better-than-expected trade fair orders and a sharp decline in raw material prices," says analyst Nigel Foo. Stock last down 0.6% at MYR1.59

Affin Cuts Kossan Target To MYR4.73; Keeps Buy

--------------------------------------------------------------------------------

0837 GMT [Dow Jones] STOCK CALL: Affin Investment lowers Kossan Rubber Industries (7153.KU) price target to MYR4.73 from MYR5.00 after revising down FY10-12 net earnings forecasts by about 6% due to expected rise in latex prices, stronger MYR vs USD. Maintains Buy rating; says company has "diversified product mix, which buffers its bottomline from higher raw material costs, and high utilization rates." Notes company's 9-month EBIT margin at 15% vs 10.3% a year earlier, driven by robust demand, stronger pricing power, especially in 1H, that allowed company to pass on nearly 100% of escalating latex costs. Stock last +5.6% at MYR3.39.

Wednesday, November 3, 2010

If you guys remember my last post on Celcom BlackBerry® Torch™ 9800, I mentioned that the launching date was on 29th October. Well, it was a hugely successful launch event.

The crowd that attended the event at Pavilion KL (in front of La Bodega) was huge. Every one was eager to get their hands on the Torch. Who wouldn’t? It’s the latest gadget in town.

There were 10 lucky customers (very very lucky), getting the Blackberry Torch at ONLY RM8. All they had to do was sign up for Celcom Blackberry postpaid plans! The next 100 lucky customers got it at RM488, and following 100 got it at RM888.

Look at the lucky 10 .....

Those were lucky customers that attended the event, but don’t fret if you missed it, you can still get the Celcom Blackberry Torch 9800 & enjoy great affordable prices plus the widest coverage with Celcom, Malaysia’s No.1 Blackberry community. It will be available from 3rd November 2010 onwards in any Blue Cube outlet nationwide.

Go and get Celcom Blackberry Torch and enjoy great savings when you sign up with Celcom postpaid plans! Check out which package below suits your needs:

You guys can sign up for any of the plans above and get awesome freebies. The freebies include FREE Blackberry Torch casing & LIMITED EDITION battery door cover!

With such a great range of packages, there is no reason to miss the opportunity to own BlackBerry® Torch™ 9800 which has amazing features, such as :

What’s more? You can stay ahead with Blackberry on Celcom – the fastest, widest, clearest mobile network!

And remember guys, not all Blackberries are the same !! Get Celcom Blackberry because it gives you the best deals in town and the widest coverage wherever you go! Celcom is Malaysia’s No.1 Blackberry community, with the best Blackberry smartphones and plans!

And with Celcom Blackberry smartphone packeages, you will enjoy absolute savings and help you stay connected while you’re on the go!

Check out our affordable package plans for various other Celcom Blackberry smartphones to suit your needs @ http://www.celcom.com.my/celcomexec/blackberry/bbtorch9800.php!

The crowd that attended the event at Pavilion KL (in front of La Bodega) was huge. Every one was eager to get their hands on the Torch. Who wouldn’t? It’s the latest gadget in town.

There were 10 lucky customers (very very lucky), getting the Blackberry Torch at ONLY RM8. All they had to do was sign up for Celcom Blackberry postpaid plans! The next 100 lucky customers got it at RM488, and following 100 got it at RM888.

Look at the lucky 10 .....

Those were lucky customers that attended the event, but don’t fret if you missed it, you can still get the Celcom Blackberry Torch 9800 & enjoy great affordable prices plus the widest coverage with Celcom, Malaysia’s No.1 Blackberry community. It will be available from 3rd November 2010 onwards in any Blue Cube outlet nationwide.

Go and get Celcom Blackberry Torch and enjoy great savings when you sign up with Celcom postpaid plans! Check out which package below suits your needs:

You guys can sign up for any of the plans above and get awesome freebies. The freebies include FREE Blackberry Torch casing & LIMITED EDITION battery door cover!

With such a great range of packages, there is no reason to miss the opportunity to own BlackBerry® Torch™ 9800 which has amazing features, such as :

Maximized multimedia

Immerse yourself with 8 GB of memory, expandable up to 32GB with a microSD card, zoom effect by a pinch of your fingers and enhanced music player that allows you to view full album art and track listings in portrait or landscape. 5 MP camera

Comes with flash, continuous auto-focus and image stabilization, plus 11 photo modes and video recording to ease those spontaneous moments. And we can upload the photos to our favourite social networks.Integrated social feeds

Now you can update multiple social networks such as Facebook, LinkedIn, Buzzd and much more with a single post or gather and filter all your social network and feeds in one view. It's that easy! Faster, richer browsing

Multi-tasks by managing multiple open websites with tabbed browsing as well as bookmark all your favourite sites with branded icons or customizable names right from the home screen.What’s more? You can stay ahead with Blackberry on Celcom – the fastest, widest, clearest mobile network!

And remember guys, not all Blackberries are the same !! Get Celcom Blackberry because it gives you the best deals in town and the widest coverage wherever you go! Celcom is Malaysia’s No.1 Blackberry community, with the best Blackberry smartphones and plans!

And with Celcom Blackberry smartphone packeages, you will enjoy absolute savings and help you stay connected while you’re on the go!

Check out our affordable package plans for various other Celcom Blackberry smartphones to suit your needs @ http://www.celcom.com.my/celcomexec/blackberry/bbtorch9800.php!

Tuesday, November 2, 2010

STOCK CALL: Affin Investment keeps Hai-O Enterprise (7668.KU) at Sell, keeps target at MYR2.71. Analyst Shakira Hatta says remains concerned at near-term earnings prospects despite plans by firm to expand into property development, expanding energy division to broaden earnings base. "We remain concerned over the sharp revenue declines in the MLM (multi-level marketing) division." MLM (which contributes about 80% of total revenue) hit by new membership recruitment guidelines; 1QFY11 MLM revenue down 51.4% on quarter, down 73% on year. "The upcoming 2QFY11 results (to be released in December) will continue to exhibit impact from the new guidelines, although management believes the earnings decline has bottomed out." Stock last down 0.3% at MYR3.06

Tuesday, October 19, 2010

Every one loves BlackBerry, my wife has been asking me to get her one, and I have been telling her …wait …coming soon. I guess it worth the wait. Blackberry is going to launch their latest model BlackBerry® Torch™ 9800, and what better way to get one than to register with Celcom - the fastest, widest, clearest mobile network!

1st 100 customers to pre-register and purchase with any Celcom Exec postpaid plans today will enjoy amazing freebies!

What are the freebies? Will let you know later, but now, we have quick look at BlackBerry® Torch™ 9800.

As we all know the convenience of a BlackBerry while we are on the go – we can stay connected via email, mobile, internet anytime, anywhere! It allows us to receive emails from our personal and business accounts, receive and open email attachments, browse through our favorite sites, stay in contact with loved ones via Instant messaging, mobile calls, sms & much much more!

What’s more, the latest new BlackBerry® Torch™ 9800 is the 1st smartphone with a BlackBerry® keyboard and full 3.2 inch touch screen for an enhanced device experience.

Just look at the picture, amazing !!!

That’s not all, BlackBerry® Torch™ 9800 also comes with dazzling features such as:

Ok now, I will let you know the FREEBIES :

- 8GB Micro SD Card worth RM68

- Energizer Portable worth RM58

Total Freebies worth RM251.00 …. Wow !!!! That’s nice huh? Now quickly go and register and be the First 100 customers to pre-register & purchase new BlackBerry® Torch™ 9800.

And to all Bursa Chatters, Celcom will be launching the Blackberry Torch 9800 this 29 October 2010. There’ll be amazing deals for the Blackberry Torch when you sign up with Celcom – at the event only! There’ll also be many other fun activities, prizes and giveaways on the day.

So don’t wait, Bursa Chatters can now pre-register at: http://www.celcom.com.my/celcomexec/blackberry/bbtorch9800_register.php

Stay ahead with Blackberry on Celcom – the fastest, widest, clearest mobile network!

Celcom is Malaysia’s No.1 Blackberry provider, with the best Blackberry smartphones and plans!

With that, allow me to introduce the Celcom Exec 50 plan, where you can get connected with Celcom from as low as only RM50 a month!

Get connected with Celcom from as low as RM50 a month!

The plan with automatic discount up to 30% every month!

The more you use; the more you save. It's as simple as that. If you find that prospect appealing, then the Celcom Exec 50 plan is definitely the plan for you.

- Automatic discounts every month.

- Talk more, save more. The more you use, the more discounts of up to 30% every month

- Low monthly commitment of only RM50.

- FREE Celcom Broadband Basic Plan for 1 month with speeds of up to 384 Kbps

- Be part of the BEST with the fastest, widest, clearest mobile network in the country

So …. To all Bursa Chatters don’t forget to check out the Blackberry Torch with Celcom Postpaid plans @ http://www.celcom.com.my/celcomexec/blackberry/bbtorch9800.php

Why would I get BlackBerry® Torch™ 9800 with Celcom? Let me tell you ….

1st 100 customers to pre-register and purchase with any Celcom Exec postpaid plans today will enjoy amazing freebies!

What are the freebies? Will let you know later, but now, we have quick look at BlackBerry® Torch™ 9800.

As we all know the convenience of a BlackBerry while we are on the go – we can stay connected via email, mobile, internet anytime, anywhere! It allows us to receive emails from our personal and business accounts, receive and open email attachments, browse through our favorite sites, stay in contact with loved ones via Instant messaging, mobile calls, sms & much much more!

What’s more, the latest new BlackBerry® Torch™ 9800 is the 1st smartphone with a BlackBerry® keyboard and full 3.2 inch touch screen for an enhanced device experience.

Just look at the picture, amazing !!!

That’s not all, BlackBerry® Torch™ 9800 also comes with dazzling features such as:

Maximized multimedia

Immerse yourself with 8 GB of memory, expandable up to 32GB with a microSD card, zoom effect by a pinch of your fingers and enhanced music player that allows you to view full album art and track listings in portrait or landscape. 5 MP camera

Comes with flash, continuous auto-focus and image stabilization, plus 11 photo modes and video recording to ease those spontaneous moments. And we can upload the photos to our favourite social networks.Integrated social feeds

Now you can update multiple social networks such as Facebook, LinkedIn, Buzzd and much more with a single post or gather and filter all your social network and feeds in one view. It's that easy! Faster, richer browsing

Multi-tasks by managing multiple open websites with tabbed browsing as well as bookmark all your favourite sites with branded icons or customizable names right from the home screen.Ok now, I will let you know the FREEBIES :

Be the 1st to own it with Celcom Exec postpaid plans!

Be the 1st 100 customers to pre-register & purchase the new BlackBerry® Torch™ 9800 today to enjoy the early bird promotion exclusively with Celcom Exec Postpaid plan.Get FREE:

- Jabra Bluetooth Headset worth RM125- 8GB Micro SD Card worth RM68

- Energizer Portable worth RM58

Total Freebies worth RM251.00 …. Wow !!!! That’s nice huh? Now quickly go and register and be the First 100 customers to pre-register & purchase new BlackBerry® Torch™ 9800.

Celcom Blackberry Torch 9800 Launch Event!

So don’t wait, Bursa Chatters can now pre-register at: http://www.celcom.com.my/celcomexec/blackberry/bbtorch9800_register.php

Celcom Exec Postpaid plan – Celcom Exec 50

Not all Blackberries are the same though – Celcom Blackberry gives you the best deals in town and the widest coverage wherever you go! Stay ahead with Blackberry on Celcom – the fastest, widest, clearest mobile network!

Celcom is Malaysia’s No.1 Blackberry provider, with the best Blackberry smartphones and plans!

With that, allow me to introduce the Celcom Exec 50 plan, where you can get connected with Celcom from as low as only RM50 a month!

Check out some of the benefits you’ll get with the plan:

Get connected with Celcom from as low as RM50 a month!

The plan with automatic discount up to 30% every month!

The more you use; the more you save. It's as simple as that. If you find that prospect appealing, then the Celcom Exec 50 plan is definitely the plan for you.

More reasons why you should choose Celcom Exec 50:

- 15sen call rate to any number. Nothing complicated; just a simple rate to all numbers- Automatic discounts every month.

- Talk more, save more. The more you use, the more discounts of up to 30% every month

- Low monthly commitment of only RM50.

- FREE Celcom Broadband Basic Plan for 1 month with speeds of up to 384 Kbps

- Be part of the BEST with the fastest, widest, clearest mobile network in the country

So …. To all Bursa Chatters don’t forget to check out the Blackberry Torch with Celcom Postpaid plans @ http://www.celcom.com.my/celcomexec/blackberry/bbtorch9800.php

Saturday, October 16, 2010

SINGAPORE, Oct. 15 (Reuters) - Malaysian palm oil is expected to retrace to 2,880 ringgit per tonne, as a bearish engulfing pattern is observed on its daily chart.

The engulfing pattern is one of the typical bearish reversals seen on a candlestick chart. As well, the rally from the Oct. 4 low at 2,653 ringgit could be too sharp not to be followed by a consolidation or retracement.

But the downside may not be limited to 2,880 ringgit, as a gap that formed between 2,808 ringgit and 2,886 ringgit could be partially filled as well.

Resistance is at 2,948 ringgit, a rise above which would open the way to 2,980.

Tuesday, October 12, 2010

Charts Hint Handal May Rise To MYR1.38 - Maybank

--------------------------------------------------------------------------------

0437 GMT [Dow Jones] STOCK CALL: Maybank IB Research rates Handal (7253.KU) at Short-Term Buy based on charts with upside targets at MYR1.22, then MYR1.38. Technical analyst Lee Cheng Hooi says stock of crane maker for offshore oil industry made daily Wave 2 low of MYR0.62 in July with grossly oversold chart signals, but price bars since rising above 18-, 40-day moving averages. "Positive crossovers from the CCI, DMI, Oscillator, Stochastic and MACD indicators support our view that Handal's share price will trend higher in the near term," says Lee. Stock last +0.9% at MYR1.17, next resistance at MYR1.25, then MYR1.44. On downside, support eyed at MYR1.16, then MYR0.99; stop-loss at MYR0.97

Monday, October 4, 2010

Businesses are always looking at ways to limit overheads to enjoy bigger profitability. High costs could include mobile services since most telcos offer packages for multi-national corporations and may not look at flexible packages for smaller businesses. Mobile service options are also limited for small businesses.

But not anymore, Celcom Biz now offer customized mobile solutions according to different business types focusing on SOHO, small & medium businesses.

To help you identify the perfect package for your business, here’s the summary of our various plans

SOHO BUSINESS

As a SOHO business such as the Suria Shoes KLCC, cutting costs and increase supply chain efficiency are key, hence, you may want to consider our mobile solutions that include mobile office and fixed wireless solutions to include:

There are also 2 flexible packages to cater to your business type with amazing offers to cater to 1- 10 employees such as:

1. 10 sen flat to any numbers, anytime

2. Lowest BlackBerry packages

3. FREE GSM Desktop Phone

Option Plan 1: RM386 Monthly Commitment

1. Option Plan 2: RM446 Monthly Commitment

SMALL BUSINESSES

For small businesses with at least 1-10 employees such as that of Transview Golf, a dynamic small-sized company, the mobile solutions that fit them well were the Celcom Biz mobile office, fixed wireless solutions and unrivalled IDD rates package.

This package includes benefits such as:

- 10 sen flat to all numbers, anytime

- Lowest IDD from 10sen/min

- FREE Celcom Broadband Wireless Router (voice + data)

Flexible options available for small businesses include:

Flexible options available for small businesses include:

OPTION PLAN 1: RM396 Monthly Commitment

Option Plan 2: RM148 Monthly Commitment

What’s best for them were the Celcom Biz hosted email solution that provided the company with an email identity with unlimited user access and also the BlackBerry® Enterprise Server express for employees’ productivity whilst on the go.

Benefits include:

- Zero Capex Hosted Email Solution

- Zero CAL BlackBerry® Enterprise Server Express License

- 10 sen flat to any numbers, anytime

Why Celcom Biz?

- Our commitment to serve

- Flexibility

- Best nationwide coverage

- Best global coverage

- Best Customer Service

To find out more about Celcom Biz, log on to www.celcom.com.my/biz

But not anymore, Celcom Biz now offer customized mobile solutions according to different business types focusing on SOHO, small & medium businesses.

To help you identify the perfect package for your business, here’s the summary of our various plans

SOHO BUSINESS

As a SOHO business such as the Suria Shoes KLCC, cutting costs and increase supply chain efficiency are key, hence, you may want to consider our mobile solutions that include mobile office and fixed wireless solutions to include:

There are also 2 flexible packages to cater to your business type with amazing offers to cater to 1- 10 employees such as:

1. 10 sen flat to any numbers, anytime

2. Lowest BlackBerry packages

3. FREE GSM Desktop Phone

Option Plan 1: RM386 Monthly Commitment

1. Option Plan 2: RM446 Monthly Commitment

SMALL BUSINESSES

For small businesses with at least 1-10 employees such as that of Transview Golf, a dynamic small-sized company, the mobile solutions that fit them well were the Celcom Biz mobile office, fixed wireless solutions and unrivalled IDD rates package.

This package includes benefits such as:

- 10 sen flat to all numbers, anytime

- Lowest IDD from 10sen/min

- FREE Celcom Broadband Wireless Router (voice + data)

OPTION PLAN 1: RM396 Monthly Commitment

Option Plan 2: RM148 Monthly Commitment

Medium-sized Businesses

Celcom Biz also has the perfect packages for medium businesses such as Poh Yap Holding, a mid-sized manufacturing company that wanted to improve cost efficiency.What’s best for them were the Celcom Biz hosted email solution that provided the company with an email identity with unlimited user access and also the BlackBerry® Enterprise Server express for employees’ productivity whilst on the go.

Benefits include:

- Zero Capex Hosted Email Solution

- Zero CAL BlackBerry® Enterprise Server Express License

- 10 sen flat to any numbers, anytime

Find out more or to sign up today!

To know more about our SME/ SMI packages that suit your business type, all you need to do is to visit the Celcom Biz site at www.celcom.com.my/biz or contact our Celcom Biz Account Manager or just call 1-800-111-777.Why Celcom Biz?

- Our commitment to serve

- Flexibility

- Best nationwide coverage

- Best global coverage

- Best Customer Service

To find out more about Celcom Biz, log on to www.celcom.com.my/biz

Saturday, September 25, 2010

STOCK CALL: Maybank IB Research rates Top Glove (7113.KU) at Take Profit based on charts with downside targets at MYR4.78, then MYR3.80, and MYR3.55. Technical analyst Lee Cheng Hooi says stock of world's largest producer of latex gloves made daily major Wave 5 high of MYR7.38 in July, with grossly overbought, bearish divergent signals, but stock now in "very strong" Wave 3 downtrend. "With the negative crossovers from the CCI, DMI, MACD, Stochastic and Oscillator indicators, we feel that Top Glove has the potential to test our downside targets," says Lee. Stock last +3.7% at MYR5.29, having breached immediate resistance at MYR5.10. Next resistance at MYR5.79.

Monday, September 20, 2010

BURSA CHAT is also affected

KUALA LUMPUR, Sept 20 — Several news portals, websites and blogs in Malaysia, including Bursa Chat and The Malaysian Insider, have been affected with warnings of malware from Google originating from Innity, an online advertising network. The search giant has now blocked some 600 websites after Innity started serving advertisements that pointed to malware infected sites.

The Wirespot Tech Blog reported that some of the sites include TheStar and MalaysiaKini. The Malaysian Insider, Berita Harian and MySinchew websites have also been affected Berita Harian's site has also gone off-line following the warnings, but it is unknown if the inaccessibility is related to the malware issue.

“According to a report on Google Safe Browsing, Innity hosted malicious software and distributed it to sites that serves the Innity ads. Owners of infected websites are recommended to remove all Innity codes/ads until Innity resolves the problem,” Wirespot reported.

Innity claimed on its website that its network serves 2.1 billion impressions and has over 29 million unique users a month. Some 250 top regional sites in Malaysia, Singapore, Thailand, Vietnam and Indonesia carry Innity Ads.

Google detected the threat on September 19 and the number of infected websites appears to be growing every hour, Wirespot said.

The malware warnings are issued by Google and appear to affect most or all of the most popular Internet browsers such as Mozilla’s Firefox, Google’s own Chrome, Microsoft’s Internet Explorer, and Apple’s Safari.

Internet users visiting several Malaysian sites were greeted by such ominous warnings.

Berita Harian’s site has become inaccessible.

“According to a report on Google Safe Browsing, Innity hosted malicious software and distributed it to sites that serves the Innity ads. Owners of infected websites are recommended to remove all Innity codes/ads until Innity resolves the problem,” Wirespot reported.

Innity claimed on its website that its network serves 2.1 billion impressions and has over 29 million unique users a month. Some 250 top regional sites in Malaysia, Singapore, Thailand, Vietnam and Indonesia carry Innity Ads.

Google detected the threat on September 19 and the number of infected websites appears to be growing every hour, Wirespot said.

The malware warnings are issued by Google and appear to affect most or all of the most popular Internet browsers such as Mozilla’s Firefox, Google’s own Chrome, Microsoft’s Internet Explorer, and Apple’s Safari.

Thursday, September 16, 2010

Wednesday, September 8, 2010

Saturday, September 4, 2010

Friday, September 3, 2010

STOCK CALL: Maybank IB Research rates UEM Land (5148.KU) at Short-Term Buy based on charts with upside targets at MYR1.96, then MYR2.04. Technical analyst Lee Cheng Hooi says stock of property firm made a recent Wave 4 retracement low of MYR1.57 in August, but has since rebounded above its 19-day simple moving average. "We believe the stock is in a strong Wave 5 uptrend. With the positive crossovers from the CCI, DMI, MACD, Stochastic and Oscillator indicators, we feel that UEM Land may rise and test the stipulated resistance level (of MYR1.91)," says Lee. Stock last +1.6% at MYR1.87. On downside, support eyed at MYR1.84, then MYR1.64; stop-loss at MYR1.62

Wednesday, September 1, 2010

KUALA LUMPUR, Sept 1 — Individual investors continue to shun the Malaysian stock market as public confidence remains shaky due to fears that the market’s recovery following the 2007 US sub-prime mortgage crisis may not be real.

Economists and analysts said that a slowdown in foreign investments, poor enforcement against unscrupulous activities and overseas competition for local funds also contributed to the lack of interest among ordinary Malaysians in investing in the local share market.

Kenanga Investment Bank economist Wan Suhaimie Wan Saidie said most investors were tired of the Malaysian stock market, which was not as competitive as other bourses in the region, and added that participation was also muted due to the lack of foreign direct investment (FDI).

“There is a correlation between retail participants and foreign investment flows,” he said, referencing the massive 81.1 per cent drop in foreign direct investment (FDI) Malaysia experienced last year.

“If foreign investment flows are not forthcoming individual investors are more likely to shun the local market.”

He said there was a possibility that investors might “go back to hibernation” until they saw signs of a firm recovery, but cautioned that the flow information both locally and abroad did not suggest that things were getting any better.

Until then, however, investors still had many other options to buy both locally and abroad or put their money into properties and commodities, he explained.

The Kuala Lumpur Composite Index’s 45 per cent gain last year lagged behind Southeast Asian neighbours even after the government announced stimulus plans totalling RM67 billion to help pull the region’s third-largest economy out of a recession.

The slump in trading by individuals coincided with an exodus by foreigners from Asean’s second-biggest stock market, leaving Bursa Malaysia more reliant on domestic institutional funds.

Overseas investors have sold a net RM1.36 billion of Malaysia’s equities this year, adding to RM8.57 billion withdrawn in 2009 and RM38.6 billion that flowed out in 2008, paring their share of local stocks down to 20.6 per cent at the end of April from 27.5 per cent in April 2007.

Wan Suhaimie was critical of the level of participation in the market by statutory funds such as Employees Provident Fund (EPF), which he said distorted the market as they focused only on index-linked stocks.

On March 30, Prime Minister Datuk Seri Najib Razak revealed that the state-controlled EPF accounted for 50 per cent of daily trading volume in the equity and bond markets. Additionally, more than half of the RM417.1 billion market value in the benchmark stock index is owned by government-linked funds, according to calculations by Bloomberg.

“It doesn’t really reflect the real overall performance of the stock market. Most of the information and research is skewed towards big cap stocks,” he said, adding that it was possible that investors might miss out on smaller companies that have better growth potential because of this.

A Hwang-DBS remisier who wanted to be identified only as Kok explained that, during good times, retail investors make up 60 to 70 per cent of trading value in a normal market.

However, according to a Bloomberg report, trading by individuals have fallen to as low as 20 percent of trading value from more than half before the start of the 1997 Asian financial crisis, when the KLCI slumped by a record 52 per cent.

Kok said the battering individual investors took in 1997 and the recent sub-prime crisis led many to put their money in safer alternatives like unit trusts or sukuks (Islamic bonds), adding that many were also still holding onto stocks that had yet to recover.

“With the market in such a lacklustre mode, you can’t make money punting,” he said. “The market is just drifting. The main market movers are just blue chip index counters... Most retail investors are still on the sidelines nursing their wounds.”

“Any spare money they’ll probably keep in interest-bearing accounts or, if they have more money, they’ll probably just park it with a fund manager.”

Most individual savings started shifting to mutual funds and unit trusts since Malaysia’s economy went into a recession in 1998 but have not returned to stock trading even as the economy expanded at an annual average of five percent over the past decade and the benchmark index more than doubled, Bursa Malaysia CEO Yusli Mohamed Yusoff said in June.

In order to boost retail investors’ share of trading to closer to one-third and tap into Southeast Asia’s second-highest savings rate, Bursa is currently working with brokerages and banks to encourage investors to open up accounts and pursue online trading.

However, Kok said he felt that investors were still wary of trading on the market because they were not convinced that Malaysia’s economic recovery was real.

“When you talk about six or seven per cent (GDP) growth, I suppose you and I don’t see it,” he said.

A broker with a local investment bank who declined to be named was similarly sceptical of the strength of the market’s recovery, pointing out that the KLCI, which is used as a bellwether for the Malaysian stock market, focused only on selected blue chip stocks.

“It is very obvious that the index, targeting only 30 counters, is not a true reflection of the overall market. A lot of the companies are actually really going down,” she said.

“Because the downtrend from ‘07, until today, in terms of all those general stocks that people buy and sell, a lot of them are still very much at the bottom.”

She added that retail investors have also been “very quiet” partly because they had lost confidence in market regulators, citing the recent case of furniture make Kenmark Industrial Co Bhd.

Kenmark’s troubles began in late May when its Taiwanese managing director James Hwang disappeared mysteriously — leading to a plunge in share price and plant closures in Port Klang and Vietnam — only to resurface nearly a week later, claiming his absence was due to illness.

During Hwang’s absence, Datuk Ishak Ismail entered the market and amassed shares amounting to a 32.36 per cent stake in the company over 10 days at prices of between 5.8 sen and 6.0 sen, claiming he had done so to help out his friend Hwang and offer re-employment to the company’s workers.

However, Ishak later sold his direct and indirect stake in Kenmark between June 9 and June 11 at between 14 sen and 16 sen after failing to convince Hwang to return to the company.

The Securities Commission finally stepped in on June 16 when it obtained a High Court order to stop Ishak from using or dealing with the RM10.16 million proceeds from the sale of shares in Kenmark as part of a move to probe possible insider trading.

Kenmark’s share price plummeted from a high of RM0.85 to just RM0.07.

“Stocks can drop from a dollar to penny stocks... These sorts of events happen in the Malaysian market, yet the authorities are not taking action,” the remisier said.

“A company doesn’t just fold up within a month. I can understand how those investors feel.”

If you like the post, please subscribe to Bursa Chat. We will send you the latest post by Email===> Click  Subscribe to Bursa Chat by Email BACK TO CHAT BOX

Subscribe to Bursa Chat by Email BACK TO CHAT BOX

Economists and analysts said that a slowdown in foreign investments, poor enforcement against unscrupulous activities and overseas competition for local funds also contributed to the lack of interest among ordinary Malaysians in investing in the local share market.

Kenanga Investment Bank economist Wan Suhaimie Wan Saidie said most investors were tired of the Malaysian stock market, which was not as competitive as other bourses in the region, and added that participation was also muted due to the lack of foreign direct investment (FDI).

“There is a correlation between retail participants and foreign investment flows,” he said, referencing the massive 81.1 per cent drop in foreign direct investment (FDI) Malaysia experienced last year.

“If foreign investment flows are not forthcoming individual investors are more likely to shun the local market.”

He said there was a possibility that investors might “go back to hibernation” until they saw signs of a firm recovery, but cautioned that the flow information both locally and abroad did not suggest that things were getting any better.

Until then, however, investors still had many other options to buy both locally and abroad or put their money into properties and commodities, he explained.

The Kuala Lumpur Composite Index’s 45 per cent gain last year lagged behind Southeast Asian neighbours even after the government announced stimulus plans totalling RM67 billion to help pull the region’s third-largest economy out of a recession.

The slump in trading by individuals coincided with an exodus by foreigners from Asean’s second-biggest stock market, leaving Bursa Malaysia more reliant on domestic institutional funds.

Overseas investors have sold a net RM1.36 billion of Malaysia’s equities this year, adding to RM8.57 billion withdrawn in 2009 and RM38.6 billion that flowed out in 2008, paring their share of local stocks down to 20.6 per cent at the end of April from 27.5 per cent in April 2007.

Wan Suhaimie was critical of the level of participation in the market by statutory funds such as Employees Provident Fund (EPF), which he said distorted the market as they focused only on index-linked stocks.

On March 30, Prime Minister Datuk Seri Najib Razak revealed that the state-controlled EPF accounted for 50 per cent of daily trading volume in the equity and bond markets. Additionally, more than half of the RM417.1 billion market value in the benchmark stock index is owned by government-linked funds, according to calculations by Bloomberg.

“It doesn’t really reflect the real overall performance of the stock market. Most of the information and research is skewed towards big cap stocks,” he said, adding that it was possible that investors might miss out on smaller companies that have better growth potential because of this.

A Hwang-DBS remisier who wanted to be identified only as Kok explained that, during good times, retail investors make up 60 to 70 per cent of trading value in a normal market.

However, according to a Bloomberg report, trading by individuals have fallen to as low as 20 percent of trading value from more than half before the start of the 1997 Asian financial crisis, when the KLCI slumped by a record 52 per cent.

Kok said the battering individual investors took in 1997 and the recent sub-prime crisis led many to put their money in safer alternatives like unit trusts or sukuks (Islamic bonds), adding that many were also still holding onto stocks that had yet to recover.

“With the market in such a lacklustre mode, you can’t make money punting,” he said. “The market is just drifting. The main market movers are just blue chip index counters... Most retail investors are still on the sidelines nursing their wounds.”

“Any spare money they’ll probably keep in interest-bearing accounts or, if they have more money, they’ll probably just park it with a fund manager.”

Most individual savings started shifting to mutual funds and unit trusts since Malaysia’s economy went into a recession in 1998 but have not returned to stock trading even as the economy expanded at an annual average of five percent over the past decade and the benchmark index more than doubled, Bursa Malaysia CEO Yusli Mohamed Yusoff said in June.

In order to boost retail investors’ share of trading to closer to one-third and tap into Southeast Asia’s second-highest savings rate, Bursa is currently working with brokerages and banks to encourage investors to open up accounts and pursue online trading.

However, Kok said he felt that investors were still wary of trading on the market because they were not convinced that Malaysia’s economic recovery was real.

“When you talk about six or seven per cent (GDP) growth, I suppose you and I don’t see it,” he said.

A broker with a local investment bank who declined to be named was similarly sceptical of the strength of the market’s recovery, pointing out that the KLCI, which is used as a bellwether for the Malaysian stock market, focused only on selected blue chip stocks.

“It is very obvious that the index, targeting only 30 counters, is not a true reflection of the overall market. A lot of the companies are actually really going down,” she said.

“Because the downtrend from ‘07, until today, in terms of all those general stocks that people buy and sell, a lot of them are still very much at the bottom.”

She added that retail investors have also been “very quiet” partly because they had lost confidence in market regulators, citing the recent case of furniture make Kenmark Industrial Co Bhd.

Kenmark’s troubles began in late May when its Taiwanese managing director James Hwang disappeared mysteriously — leading to a plunge in share price and plant closures in Port Klang and Vietnam — only to resurface nearly a week later, claiming his absence was due to illness.

During Hwang’s absence, Datuk Ishak Ismail entered the market and amassed shares amounting to a 32.36 per cent stake in the company over 10 days at prices of between 5.8 sen and 6.0 sen, claiming he had done so to help out his friend Hwang and offer re-employment to the company’s workers.

However, Ishak later sold his direct and indirect stake in Kenmark between June 9 and June 11 at between 14 sen and 16 sen after failing to convince Hwang to return to the company.