Last night, the bears marked their arrival in the US markets with a big black candle . Wielding the disappointing jobs report in the US as its main weap on, the bears knocked 2.63% off the Dow Jones. It is likely th at more negativity will follow suit

Disappointing jobs Report in US and UK

Last night, the US Labor Department announced unemployment rates of 9.5% and a decrease of non farm payrolls of 467,000 jobs. To compound matters further, Eurostat also announced unemployment rates of 9.5% for the Euro Zone in May. The bears are sending a message : the American and UK Economies have yet to show a tangible and significant recovery and the 25%-30% global equities rally in the last 3 months may have overshot and overestimated the recovery in the US and the Euro Zone.

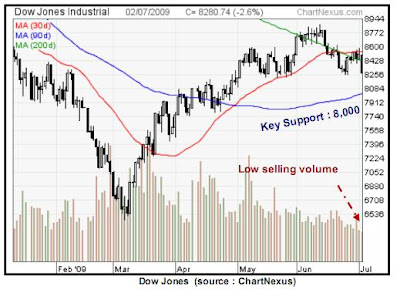

Dow J ones trading below 30 and 200 day trend line : Low Volume Sell-down

The bears have now steered the Dow cl earl y b elo w its important 30 and 200 day MAV lines, which signals bea rishness in the days ahead.

However, an interesting technical development emerged last night. The sell -down in the Dow was accompanied by relatively low volume which emphasized the fact tha t the sell-down may be over exaggera ted by a lack of buyers instead of mass panic selling. While we are now negative on the Dow Jones, we are monitoring the key 8,000 support level to gauge the strength of this new rookie bear. The bulls are still hiding nearby, ready to pounce if they see weaknsses in this new bear

Disappointing jobs Report in US and UK

Last night, the US Labor Department announced unemployment rates of 9.5% and a decrease of non farm payrolls of 467,000 jobs. To compound matters further, Eurostat also announced unemployment rates of 9.5% for the Euro Zone in May. The bears are sending a message : the American and UK Economies have yet to show a tangible and significant recovery and the 25%-30% global equities rally in the last 3 months may have overshot and overestimated the recovery in the US and the Euro Zone.

Dow J ones trading below 30 and 200 day trend line : Low Volume Sell-down

The bears have now steered the Dow cl earl y b elo w its important 30 and 200 day MAV lines, which signals bea rishness in the days ahead.

However, an interesting technical development emerged last night. The sell -down in the Dow was accompanied by relatively low volume which emphasized the fact tha t the sell-down may be over exaggera ted by a lack of buyers instead of mass panic selling. While we are now negative on the Dow Jones, we are monitoring the key 8,000 support level to gauge the strength of this new rookie bear. The bulls are still hiding nearby, ready to pounce if they see weaknsses in this new bear

KLCI :

As the KLCI is highly correlated to the US’ Dow Jones, we can expect a sell-down in the KLCI today. However, we are not yet ready to call a bear for the KLCI yet as the sell-down in the US and the KLCI was accompanied by relatively low volume, which signals lack of strength in the bears. We will be monitoring two factors in today’s KLCI negative day :

i) MAV support of 1,065 and

ii) Banking and Crude PalmOil (CPO) stocks.

The short term dynamic 30 day support of the KLCI lies at the 1065 level, and will be a test of the strength of the bears. A breach downwards by the bears will signal more negative days ahead. We will also be monitoring banking and CPO counters closely today as positive volume and interests have picked up for these two sectors yesterday. Obviously, the original plan of the bulls were for these two sectors to power the KLCI higher in the near term. If these two sectors suffer significant technical damage today, we may be pressured to accord more weightage to the KLCI’s bearish force.

i) MAV support of 1,065 and

ii) Banking and Crude PalmOil (CPO) stocks.

The short term dynamic 30 day support of the KLCI lies at the 1065 level, and will be a test of the strength of the bears. A breach downwards by the bears will signal more negative days ahead. We will also be monitoring banking and CPO counters closely today as positive volume and interests have picked up for these two sectors yesterday. Obviously, the original plan of the bulls were for these two sectors to power the KLCI higher in the near term. If these two sectors suffer significant technical damage today, we may be pressured to accord more weightage to the KLCI’s bearish force.

===> Click

BACK TO CHAT BOX

.png)

No comments:

Post a Comment