KLCCP (5089) @ RM2.97 ==> By Zhuge Liang

– The one-stop Recreation, Relaxation and Retail center

KLCCP is a defensive property stock which offers stable organic growth with its rental rates and a host of strong key tenants housed in its assets. In line with the rally in the market last week, KLCCP rose 4.9% WoW to RM2.97 on Friday.

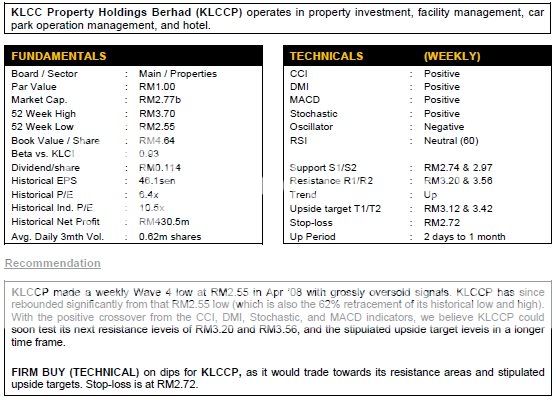

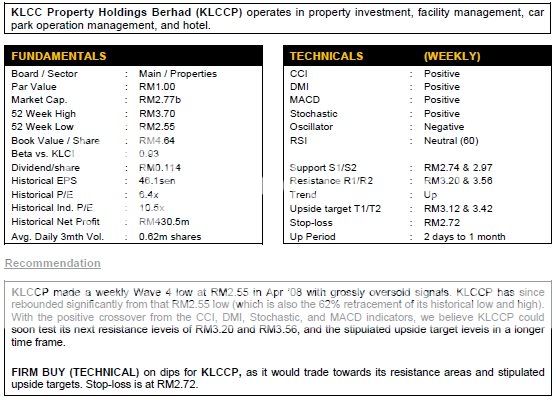

Chart-wise, technical indicators suggest that there could be potential upside for the stock in the near future.

Meanwhile, property analyst has recommended BUY call on the stock with an unchanged RNAV based target price of RM3.60 with a sustainable gross dividend yield of > 5%.

KLCCP owns prominent property assets including Petronas Twin Towers, Suria KLCC, Mandarin Oriental, Menara Exxonmobil, Menara Maxis and Kompleks Dayabumi. These assets are strategically located, providing

its patrons the convenience of office space, recreation, relaxation and retail all rolled into one. Consequently, the company has been able to demand favorable rental rates, riding on its stable and strong key tenants, and has locked in 55% of its rental from Petronas Twin Towers, Menara Maxis and Menara Exxonmobil.

Also, the expansion of Suria KLCC will provide the company with higher

earnings as there are a large number of potential tenants on the waiting list. Market property analysts estimate Suria KLCC to contribute 31% to KLCCP’s FY09 EBIT.

The company reported a 1H09 net profit of RM114.2m (-8.8%YoY) on the back of its 1H09 revenue of RM430.9m (+2.0%), lifted by increased rental of office buildings (particularly Dayabumi, due to higher occupancy and rental division), increased rental from the retail mall (higher rentals) and increase in revenue from facilities management, which offset lower revenue from hotel operations. PBT also increased due to lower finance costs incurred during the period.

On the charts, it showed some great long-term buying opportunities at the support areas for KLCCP. The 2008 plunge in the local equity market saw KLCCP hit a low of RM2.55 (Apr ’08) – which is the key 62% Fibonacci

support for the long-term. In short, KLCCP is very defensive to the downside and should be a great long-term buy for institutional funds or individual investors.

If you like the post, please subscribe to Bursa Chat. We will send you the latest post by Email

===> Click Subscribe to Bursa Chat by Email

Subscribe to Bursa Chat by Email

BACK TO CHAT BOX

– The one-stop Recreation, Relaxation and Retail center

KLCCP is a defensive property stock which offers stable organic growth with its rental rates and a host of strong key tenants housed in its assets. In line with the rally in the market last week, KLCCP rose 4.9% WoW to RM2.97 on Friday.

Chart-wise, technical indicators suggest that there could be potential upside for the stock in the near future.

Meanwhile, property analyst has recommended BUY call on the stock with an unchanged RNAV based target price of RM3.60 with a sustainable gross dividend yield of > 5%.

KLCCP owns prominent property assets including Petronas Twin Towers, Suria KLCC, Mandarin Oriental, Menara Exxonmobil, Menara Maxis and Kompleks Dayabumi. These assets are strategically located, providing

its patrons the convenience of office space, recreation, relaxation and retail all rolled into one. Consequently, the company has been able to demand favorable rental rates, riding on its stable and strong key tenants, and has locked in 55% of its rental from Petronas Twin Towers, Menara Maxis and Menara Exxonmobil.

Also, the expansion of Suria KLCC will provide the company with higher

earnings as there are a large number of potential tenants on the waiting list. Market property analysts estimate Suria KLCC to contribute 31% to KLCCP’s FY09 EBIT.

The company reported a 1H09 net profit of RM114.2m (-8.8%YoY) on the back of its 1H09 revenue of RM430.9m (+2.0%), lifted by increased rental of office buildings (particularly Dayabumi, due to higher occupancy and rental division), increased rental from the retail mall (higher rentals) and increase in revenue from facilities management, which offset lower revenue from hotel operations. PBT also increased due to lower finance costs incurred during the period.

On the charts, it showed some great long-term buying opportunities at the support areas for KLCCP. The 2008 plunge in the local equity market saw KLCCP hit a low of RM2.55 (Apr ’08) – which is the key 62% Fibonacci

support for the long-term. In short, KLCCP is very defensive to the downside and should be a great long-term buy for institutional funds or individual investors.

===> Click

BACK TO CHAT BOX

.png)

No comments:

Post a Comment