By Zhuge Liang

Please subscribe to Bursa Chat. We will send you the latest post by Email

===> Click Subscribe to Bursa Chat by Email

Subscribe to Bursa Chat by Email

BACK TO CHAT BOX

DJIA Vague Hammer formation

In addition, there was a vague hammer candlestick formation in the Dow last night. Although this hammer candlestick formation was not a white candle for it to be considered a pure hammer, nevertheless it does reaffirms the status quo bullish underlying strength of the Dow.

In addition, there was a vague hammer candlestick formation in the Dow last night. Although this hammer candlestick formation was not a white candle for it to be considered a pure hammer, nevertheless it does reaffirms the status quo bullish underlying strength of the Dow.

The Dow also managed to hold above its short term MAV lines which means that the bears are kept at bay, at least for now.

Strategy : Maintain Bullish stance in the short term

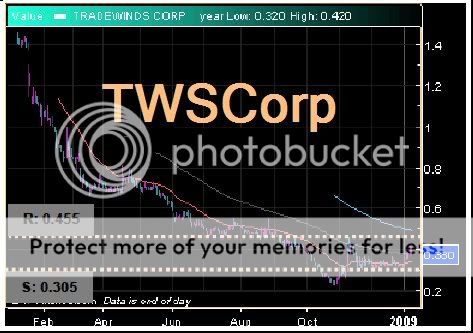

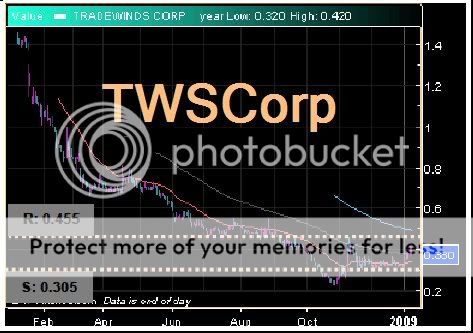

The reaffirmation of the bull would see us maintaining the status quo call of a short term bull. We hold on to our recommendation of trades in banking stocks as well as other second liner stocks like TWSCORP and KUB.

Strategy : Maintain Bullish stance in the short term

The reaffirmation of the bull would see us maintaining the status quo call of a short term bull. We hold on to our recommendation of trades in banking stocks as well as other second liner stocks like TWSCORP and KUB.

===> Click

BACK TO CHAT BOX

.png)

No comments:

Post a Comment